For tax years ending: On or after December 31, 2014, you must. partner’s income tax return.įor questions about this issue or other international tax matters, please contact our international tax professionals. Individuals cannot claim the exemption from pass-through withholding by filing Form IL-1000-E. The Form 8865 instructions discuss this option and outline the appropriate schedules that need to be attached to the U.S. Aside from a few exceptions, all domestic partnerships are required to file a Partnership Tax Return. However, certain schedules of the Form 8865 would not be needed. Those partners would still need to attach a Form 8865 to their U.S.

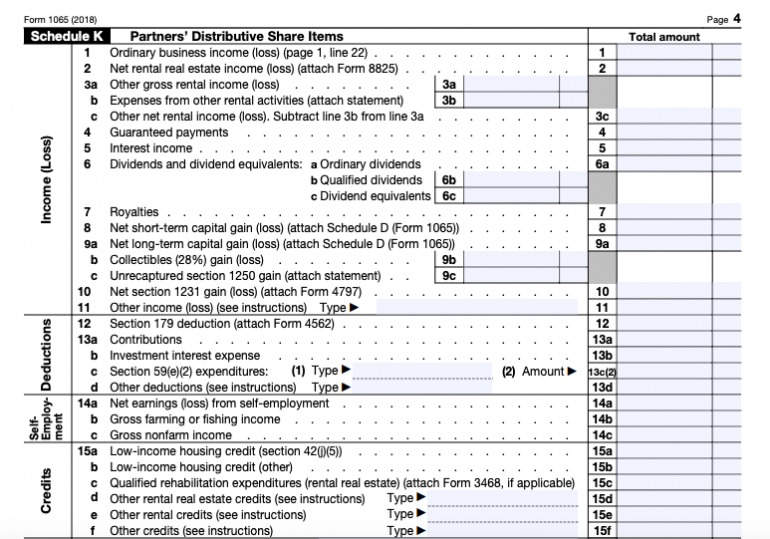

If the foreign partnership were to file a Form 1065, it would then provide a K-1 to its partners.

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

investments and are, therefore, required to file a Form 1065 and issue K-1s to the U.S. Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax. In our practice we often see partnerships that are organized outside of the U.S. This is outlined in the Form 1065 instructions. Sources: Section 6031(e)(2) may require a foreign partnership to file a Form 1065 in a tax year where (A) the partnership has gross income derived from sources within the United States, or (B) gross income connected with a trade or business conducted in the U.S. There are, however, a couple of instances in which a foreign partnership would file a Form 1065: income tax return, assuming they qualify as one of the categories of 8865 filers. partners would attach Form 8865 to their U.S. Typically, a foreign partnership with U.S. A common question is when it would be appropriate to file a Form 1065 for a foreign partnership.

Return of Partnership Income by the 15th day of the third month following the date its tax year. At this time of year, we prepare a lot of 10 forms for U.S. Generally, a domestic partnership must file Form 1065 U.S.

0 kommentar(er)

0 kommentar(er)